zero down chapter 7 Virginia - An Overview

We want they ended up somewhat more forthcoming about what a potential borrower can hope, In particular with regards to bank loan quantities, conditions, and APR's. Continue to, we see brilliant points ahead for this relative newcomer.

If you’re now late on the bank card payments, You may have a lousy rating and also have a hard time finding debt consolidation companies that can approve you.

The vast majority of leftover debt will likely be forgiven. With a Chapter 13 bankruptcy, the court docket will purchase you to Are living inside a spending plan for as much as five many years, in which period most of your financial debt can be repayed. Either way, creditors will cease calling and you can begin getting your fiscal daily life back as a way.

Looking through consumer assessments and testimonials may also present a must have insights into the company's name and customer satisfaction.

This documentation is vital in demonstrating your existing earnings, assets, liabilities, and charges into the bankruptcy court docket. Let's take a look at the process of documenting money standing in preparing for bankruptcy submitting.

Whilst financial debt consolidation loans can be quite valuable, there are many downsides to contemplate. Initial, they’re nonetheless loans, which means you’ll want to stay on top of monthly payments. For those who fall short to, you might encounter late charges and probable hits to the credit history rating.

For example, In case your personal debt-to-income ratio is significant—indicating a significant portion of one's revenue is Click This Link currently allocated to spending off present debts—chances are you'll come across it challenging to deal with added legal professional expenses upfront without the need of negatively impacting other essential expenses.

Bankruptcy can be quite a stressful and frustrating procedure, and the idea of with the ability to file devoid of shelling out original site any upfront costs might seem appealing. Even so, it’s important to know this selection’s implications and potential negatives.

We really like the in-depth information offered on Each and every lending partner, with 1000s of you could check here consumer opinions to help decide which one particular is your best option for a private financial loan. LendingTree has an excellent standing and is particularly a trusted possibility if you would like make use of a referral services to study and safe a financial loan.

It allows people to initiate the bankruptcy procedure devoid of shouldering the significant load of upfront attorney service fees, making it much more attainable for anyone facing money see this website hardship.

That will depend on the assistance, but Indeed: most personal debt consolidation courses give you a financial loan to pay back all of your current excellent debts. These financial loans generally have Considerably reduce interest fees and can help you get on top of your monetary problem yet again.

Now, Fisker stock is slipping quick over the information, at the moment down over 50% for that working day. These declines are most likely to continue since the battling company accelerates its race to the bottom.

Countrywide Personal debt Aid works difficult to determine what monetary try these out choice will function greatest for each unique client. A significant BBB score, Skilled staff, and a shopper pleasure ensure pushes National Credit card debt

On the other hand, if your money exceeds the median, added calculations should be made. The second Component of the Usually means Examination evaluates your disposable money right after deducting selected allowable bills specified by legislation.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Barbara Eden Then & Now!

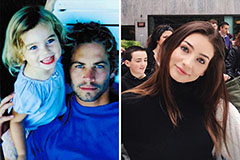

Barbara Eden Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!